Global Mobile Subscription Trends by Region and Technology (2021–2027): The Shift Toward 5G Dominance

Global Mobile Subscription Trends by Region and Technology (2021–2027)

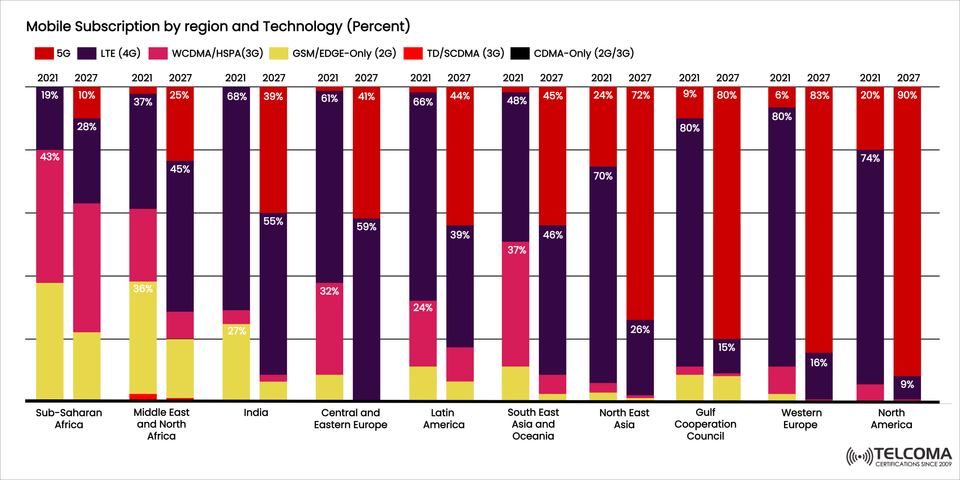

The landscape of mobile technology is changing rapidly. The chart above clearly shows that mobile subscriptions are experiencing a significant transformation across various regions worldwide from 2021 to 2027. We're seeing a notable shift toward 5G, moving away from 4G (LTE) and older 3G/2G networks as users demand faster, more reliable connectivity.

This article dives into regional trends and breaks down what the data means for telecom operators, policymakers, and strategies for mobile network development.

Overview: Transitioning to 5G by 2027

By 2027, 5G is set to become the leading technology globally. As illustrated in the image, most regions are expected to have 40%–90% of mobile subscriptions on 5G networks by then. While LTE (4G) will still play a significant role in transitional areas, older technologies like 3G and 2G are quickly being phased out.

Global Highlights:

5G adoption is expected to skyrocket in all regions by 2027.

LTE (4G) remains strong in emerging markets but will start to decline as 5G becomes more prevalent.

The usage of 3G (WCDMA/HSPA, TD-SCDMA, CDMA) and 2G (GSM/EDGE) is decreasing, especially in developed areas.

Asia, North America, and Europe are leading the charge in 5G penetration.

Regional Analysis: Mobile Technology Share in 2021 and 2027

Now, let’s break down the data from the image by region.

Sub-Saharan Africa

2021: Predominantly 2G (GSM/EDGE) and 3G (WCDMA/HSPA).

2G: ~43%

3G: ~28%

4G: ~19%

5G: ~10%

2027: 5G usage climbs to 10%, but 4G takes the lead at 43%.

Insight: Challenges like limited infrastructure and affordability are slowing down 5G rollout. However, projects to expand LTE coverage and the availability of affordable smartphones are improving access.

Middle East and North Africa (MENA)

2021: LTE is in charge at 37%, with a strong 3G presence (~36%).

2027: 5G jumps to 25%, surpassing 3G as operators retire older networks.

Insight: Increased investments from Gulf countries (UAE, Saudi Arabia, Qatar) are boosting regional 5G growth, although North Africa is a bit behind.

India

2021: Heavily dependent on 4G (~68%), with only a small 5G footprint.

2027: 5G jumps to 39%, while LTE dips to 55%.

Insight: With companies like Jio, Airtel, and Vodafone Idea pushing 5G networks, India is in the midst of a telecom revolution, and mass-market 5G uptake is on the horizon by 2026.

Central and Eastern Europe

2021: 4G makes up ~61%, with 3G at 32%.

2027: 5G grabs 41% of subscriptions, while 4G drops to 59%.

Insight: This gradual shift is influenced by EU digital policies and ongoing upgrades to outdated infrastructure.

Latin America

2021: 4G is dominant at 66%, with 3G holding 24%.

2027: 5G reaches 44%, significantly replacing 3G and bringing 4G down to 39%.

Insight: Countries such as Brazil, Chile, and Mexico are propelling 5G growth, especially with recent spectrum auctions speeding things up.

South East Asia and Oceania

2021: Strong presence of both 4G (48%) and 3G (37%).

2027: 5G surpasses both at 45%, with 4G falling to 46%.

Insight: Early adopters like Singapore, Australia, and Thailand are leading regional 5G growth, while developing countries continue to expand 4G.

North East Asia

2021: 4G is in the lead at 70%, with 5G still emerging at 24%.

2027: A major jump—5G takes over at 72%, with 4G dropping to 26%.

Insight: China, South Korea, and Japan are at the forefront of 5G infrastructure, smoothly transitioning to new technology. China alone represents more than half of global 5G users.

Gulf Cooperation Council (GCC)

2021: 4G remains prevalent at 80%.

2027: 5G skyrockets to 80%, surpassing all previous technologies.

Insight: Gulf nations like Saudi Arabia, UAE, and Qatar are leading 5G deployments, backed by smart city projects and abundant spectrum availability.

Western Europe

2021: 4G is king at 83%, with 3G nearly gone.

2027: 5G steps up to claim 74% of the market.

Insight: Aggressive strategies from operators and EU’s 5G corridors fuel this growth. Many Western European providers aim to phase out 3G/2G networks by 2025.

North America

2021: 4G covers 80%, while 5G is only at 9%.

2027: 5G skyrockets to 90%, dropping 4G to 9%.

Insight: The U.S. and Canada are leading in 5G maturity, thanks to large-scale rollouts from Verizon, AT&T, and T-Mobile and their use of mid-band spectrum (C-band).

Global Trend Summary

Region5G Share (2027)Key Trend North America90%5G becomes the universal standard Western Europe74%3G shutdown accelerates 5G growth Gulf Cooperation Council80%Smart city initiatives drive 5GNorth East Asia72%China and South Korea dominate 5G users South East Asia & Oceania45%Mix of mature and emerging markets Latin America44%Spectrum auctions boost expansionIndia39%Massive 5G rollout by major operatorsMENA25%Growth led by Gulf nations Sub-Saharan Africa10%LTE expansion remains focus

Technology Evolution Insights

a. 5G Becomes the Global Standard

By 2027, 5G will account for over two-thirds of global subscriptions.

Operators are decommissioning older networks to make room for 5G.

The main drivers include IoT, Industry 4.0, and enhanced mobile broadband (eMBB).

b. LTE (4G) Stays Important During the Transition

LTE will still act as a fallback technology and primary access point in developing areas.

4G networks will continue to facilitate Voice over LTE (VoLTE) and various IoT applications.

c. The Decline of 3G and 2G

3G networks (WCDMA, TD-SCDMA, CDMA) are gradually being phased out globally.

2G (GSM/EDGE) is now mostly limited to rural and low-ARPU areas for basic voice and M2M services.

Strategic Implications for Operators

a. Network Modernization

Telecom operators need to find the right balance between expanding 5G coverage and ensuring 4G quality during this transition phase.

b. Spectrum Reallocation

Re-allocating spectrum from 3G/2G to 4G/5G is essential for maximizing capacity and efficiency.

c. 5G Monetization Models

New revenue opportunities will come from:

Fixed Wireless Access (FWA)

Private 5G networks

IoT and connected industries

Edge computing and low-latency services

d. Policy and Regulation

Governments have a crucial role in:

Efficiently allocating 5G spectrum

Reducing barriers to deployment

Supporting rural connectivity initiatives

Future Outlook: 2027 and Beyond

The data paints a clear picture of technology convergence:

5G is more than just a simple upgrade; it’s a platform for future innovation.

Research into 6G is already underway, focusing on AI-native networks, terahertz bands, and quantum security.

The groundwork laid by 5G is set to enable smart cities, autonomous driving, and immersive metaverse applications.

Conclusion

The chart provides a fascinating overview of the global evolution of mobile connectivity. By 2027, 5G will be the leading technology in nearly every region, signaling the end of the 2G/3G era.

Regions like North America, Northeast Asia, and Western Europe will hit 5G saturation, while India, Latin America, and MENA will continue to progress. Sub-Saharan Africa is still focused on expanding LTE, but long-term prospects for 5G look encouraging as infrastructure investments increase.

Ultimately, this transition is more than just a change in technology; it’s redefining connectivity, paving the way for a future where speed, latency, and intelligence will shape the next generation of mobile experiences.