Magic Quadrant for 5G Network Infrastructure: Leaders, Challengers, and Visionaries

Magic Quadrant for 5G Network Infrastructure (2021): Leaders, Challengers, and Visionaries

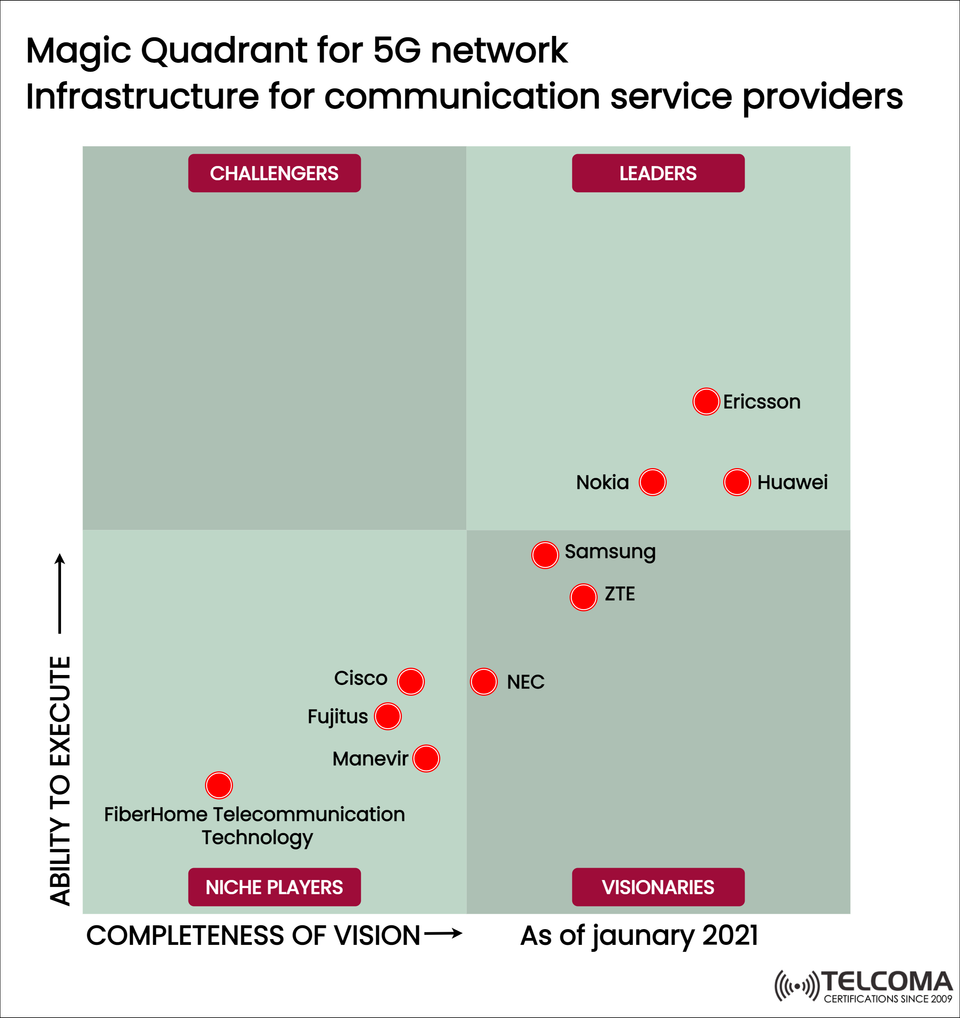

As 5G networks keep evolving, telecom operators are counting on infrastructure vendors to provide high performance, innovation, and reliability. The Magic Quadrant framework offers a visual way to assess how these companies stack up based on their ability to execute and completeness of vision.

The chart shared, Magic Quadrant for 5G Network Infrastructure for Communication Service Providers (as of January 2021), categorizes key vendors into Leaders, Challengers, Visionaries, and Niche Players.

In this blog, we’ll dive into:

What the Magic Quadrant means for telecom.

A deeper look at each category.

Where top vendors like Ericsson, Huawei, and Nokia fit in.

What this means for telecom operators.

The future for 5G infrastructure providers.

What is the Magic Quadrant in Telecom?

The Magic Quadrant is a marketing research tool for assessing vendors in a particular industry. For 5G infrastructure, it evaluates vendors across two main axes:

Ability to Execute (Y-axis): This measures how well a company is doing in delivering its current products and services, factoring in quality, responsiveness to the market, and financial stability.

Completeness of Vision (X-axis): This reflects a company's innovation, roadmap, and strategy for addressing changing market demands.

The quadrant breaks down into four categories:

Leaders: Companies with strong execution and strong vision.

Challengers: Companies with strong execution but a weaker vision.

Visionaries: Those with a robust vision but weaker execution.

Niche Players: Vendors with limited execution and vision.

Leaders in 5G Network Infrastructure

The Leaders quadrant includes vendors who are doing great in both execution and vision, making them preferred picks for telecom operators.

Ericsson

Position: High ability to execute, balanced vision.

Strengths: Strong R&D, significant global market share, reliable interoperability, and a complete 5G portfolio.

Why it’s a leader: Ericsson is consistently rated highly for reliability and innovation, aiding operators in both NSA and SA 5G rollouts.

Huawei

Position: High in both execution and vision.

Strengths: A vast array of 5G patents, extensive deployments, competitive pricing.

Challenges: Trade restrictions in various areas limit its growth potential.

Why it’s a leader: Even with geopolitical hurdles, Huawei remains a strong contender in innovation and scaling.

Nokia

Position: Moderately executing, with a strong vision.

Strengths: Comprehensive 5G solutions, leadership in Open RAN, broad partnerships with operators.

Why it’s a leader: Nokia's long-term vision for cloud-native networking solidifies its leadership stance.

Visionaries in 5G

Visionaries are forward-thinking but may struggle with large-scale execution.

Samsung

Position: Mid-level in execution, strong vision.

Strengths: Increasing presence in US and Asian markets, open architecture.

Why it’s a visionary: Their emphasis on next-gen mmWave and software-defined solutions sets them apart.

ZTE

Position: Like Samsung, it has a strong vision but limited global execution.

Strengths: Competitive in Asian markets and aggressive investments in R&D.

Why it’s a visionary: Offers cost-effective 5G solutions.

NEC

Position: Weaker execution, yet innovative vision.

Strengths: Partnerships in Open RAN and cloud-native infrastructure.

Why it’s a visionary: NEC is pushing for disaggregation and multi-vendor interoperability.

Challengers in 5G

The Challengers quadrant generally includes vendors that excel in execution in their niches but lack a robust long-term vision. Interestingly, this chart doesn't feature any specific vendor in the Challengers category, highlighting how rare it is to see execution without a vision in the race for 5G infrastructure.

Niche Players in 5G

Niche Players are those with limited execution or vision, often targeting specialized markets.

Cisco

Strengths: Expertise in core networking and cloud integration.

Challenges: Not as strong in radio access infrastructure compared to leaders.

Fujitsu

Strengths: Focus on Open RAN and the Japanese ecosystem.

Challenges: Global scale and adoption issues.

Manevir

Strengths: Regional deployments and niche offerings.

Challenges: Limited recognition in the market and a small global presence.

Fiber Home Telecommunication Technology

Strengths: Established presence in China and cost-effective infrastructure.

Challenges: Lacks a broader vision and execution outside its home market.

Vendor Comparison Table

Vendor Quadrant Key Strength Key Challenge Ericsson Leader Proven execution, global reach Pricing competition Huawei Leader Strong R&D, deployment scale Trade restrictions Nokia Leader Cloud-native vision, Open RAN Slower execution Samsung Vision arymmWave innovation Limited global share ZTE Visionary Cost-efficient solutions Global expansion limits NEC Visionary Open RAN leadership Execution capability Cisco Niche Player Core networking Weak in RAN Fujitsu Niche Player Open RAN focus Limited reach Manevir Niche Player Regional solutions Small footprint Fiber Home Niche Player Chinese market strength Low global vision

Strategic Implications for Operators

Telecom operators need to carefully consider vendor positions before going ahead with big 5G rollouts.

Leaders (Ericsson, Huawei, Nokia): These are safe bets for long-term partnerships.

Visionaries (Samsung, ZTE, NEC): Great for operators wanting innovation and uniqueness.

Niche Players (Cisco, Fujitsu, etc.): Best for specialized deployments, Open RAN trials, or tackling specific markets.

Operators often go with a multi-vendor strategy, balancing reliability from leaders with the innovative edge of visionaries.

Trends Driving Vendor Positioning

Open RAN adoption: Companies like NEC and Fujitsu are gaining traction for their disaggregated solutions.

Geopolitical factors: Restrictions on Huawei are nudging operators toward Ericsson, Nokia, and Samsung.

Cloud-native 5G cores: Vendors with robust software portfolios are gaining recognition in vision.

Regional dominance: Chinese vendors do well domestically, while Ericsson and Nokia take the lead in Europe and North America.

Innovation in mmWave and Massive MIMO: Samsung and ZTE are paving the way for future applications.

Future Outlook

Ericsson and Nokia seem poised to maintain their leadership as operators lean towards proven vendors.

Huawei’s future relies on how it tackles geopolitical challenges.

Samsung and ZTE are expected to improve their execution as they sign more global contracts.

Open RAN vendors (NEC, Fujitsu, Cisco) may shake up the quadrant in the coming years as disaggregated networks become more established.

Niche players might choose to broaden their partnerships or stick to their specialized roles.

Conclusion

The Magic Quadrant for 5G network infrastructure (2021) showcases the competitive landscape among telecom vendors.

Leaders (Ericsson, Huawei, Nokia): They’re the strongest in both execution and vision, leading global deployments.

Visionaries (Samsung, ZTE, NEC): These are the innovators shaping the future of 5G.

Niche Players (Cisco, Fujitsu, Manevir, FiberHome): They play specialized roles, contributing to targeted markets or Open RAN advancements.

For those in telecom and interested parties, this quadrant offers a glimpse into how vendors are shaping the 5G race. As networks develop, anticipate shifting positions, new collaborations, and breakthrough innovations that will redefine the telecom industry.